So, you’re ready to buy a house? Congratulations! It’s an exciting time, but it can also be overwhelming, especially when it comes to finances. One of the most crucial steps in the home buying process is getting pre-approved for a mortgage. In this blog post, we’ll discuss why and when you should get pre-approved for a mortgage before starting to shop for a house.

Why Should You Get Pre-Approved for a Mortgage?

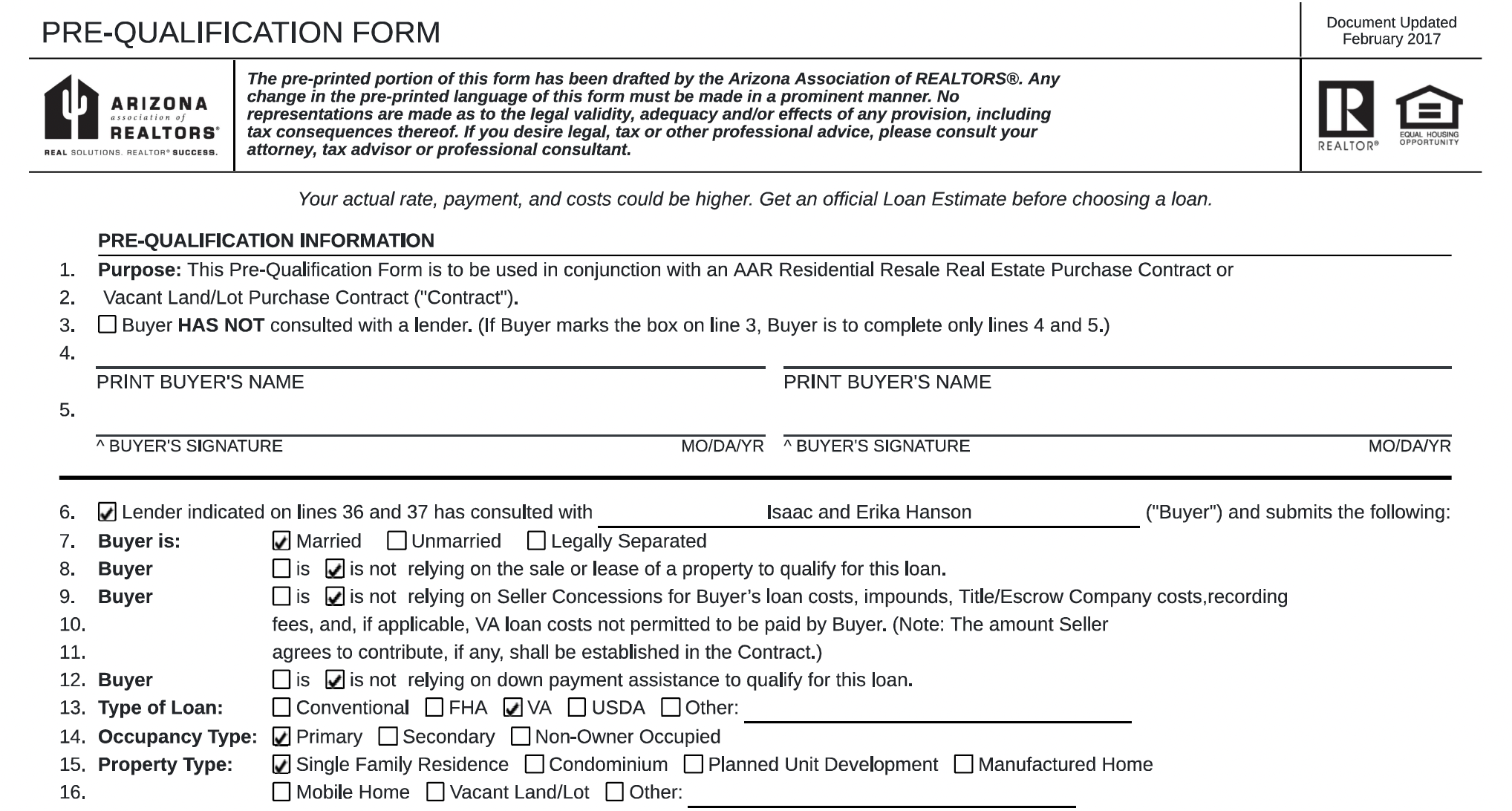

Getting pre-approved for a mortgage is an essential step in the home buying process. It’s a preliminary review by a lender to determine if you qualify for a home loan and how much you can afford. There are several reasons why you should get pre-approved for a mortgage before starting to shop for a house.

Firstly, it helps you set a budget. When you get pre-approved, you’ll know how much you can afford to borrow. This helps you narrow down your home search to properties that are within your price range, saving you time and effort.

Secondly, it gives you an advantage in a competitive market. In a hot housing market, there may be multiple offers on a property. Having a pre-approval letter shows sellers that you’re serious and financially prepared to buy their home. This can give you an edge over other buyers who don’t have pre-approval.

Thirdly, it helps you understand your financial position. When you get pre-approved, you’ll receive a breakdown of your estimated monthly mortgage payments, including principal, interest, taxes, and insurance. This information can help you understand your monthly expenses and make informed financial decisions.

When Should You Get Pre-Approved for a Mortgage?

Now that you understand why getting pre-approved for a mortgage is essential let’s talk about when you should get pre-approved.

The short answer is that you should get pre-approved for a mortgage before starting to shop for a house. Don’t make the mistake of falling in love with a home before knowing how much you can afford to borrow. This can lead to disappointment and wasted time.

Ideally, you should start the pre-approval process at least 60 days before you plan to buy a home. This gives you enough time to gather all the necessary documents and shop around for the best rates and terms.

How to Get Pre-Approved for a Mortgage?

Getting pre-approved for a mortgage is a straightforward process. You’ll need to gather some documents, such as your W-2s, pay stubs, tax returns, and bank statements. You’ll also need to provide information about your credit score, employment history, and debts.

Once you have all the necessary documents, you can apply for pre-approval with a lender. You can choose to apply with a bank, credit union, or mortgage broker. Shop around to compare rates and terms to find the best option for you.

After you apply, the lender will review your information and determine if you qualify for a home loan. If you’re approved, you’ll receive a pre-approval letter that outlines how much you can borrow and the terms of the loan.

In conclusion, getting pre-approved for a mortgage is an essential step in the home buying process. It helps you set a budget, gives you an advantage in a competitive market, and helps you understand your financial position. Don’t make the mistake of falling in love with a home before knowing how much you can afford to borrow. Start the pre-approval process before starting to shop for a house, ideally at least 60 days before you plan to buy. Shop around to find the best rates and terms, and enjoy the exciting journey of finding your dream home.

Leave A Comment