This episode is about escrow and title, and the inspection period, financing, and actually closing the deal the end of the process.

Conrad 0:00

In this episode, I’m going to talk about escrow, and title, and talk about the inspection period, and financing. And actually closing the deal the end of the process.

Conrad 0:10

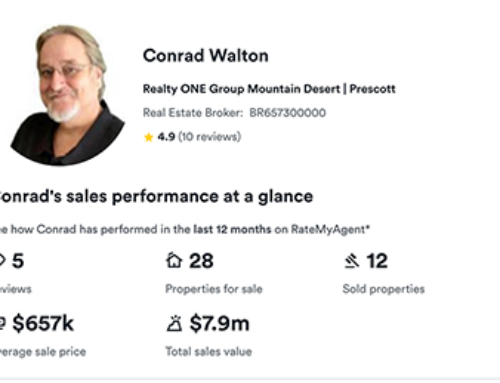

This is Selling Prescott, a project of PrescottRealEstate.com. I’m Conrad Walton.

Conrad 0:26

So at this point, you have an accepted contract. And we’ve opened escrow and we’re starting this “close of escrow” process. The first thing that’s going to happen after we open an escrow account is that the escrow company will contact you, the seller, directly, with paperwork that you’ve got to fill out and send back to them.

Conrad 0:48

And you should always talk directly to your escrow agent, about any kind of money issues, any kind of deeds, and legal stuff. Wire fraud is a thing.

Conrad 0:58

People were sending emails saying, “Oh by the way, here, I got a new email account, you know, send your wire instructions here.” And then, you know, people would pay for the house. But it would go to some random person who’d, you know, send the money out of the country and we lose the money. So talk directly on the phone, if possible, with your escrow agent, about any kind of money, paperwork, legal issues.

Conrad 1:24

So the inspection period, this is the fun time. They can, the buyer, they can inspect anything they want during this period. They’ve got to give you notice, and you know, respect a few things. But basically, they can have anybody inspect anything.

Conrad 1:41

They could do a termite inspection or not. They could do a well inspection. They could have their friend family come over, you know. Does the sister like the blue that you painted the wall in the kitchen? Whatever, you know. You’ve got to give them access.

Conrad 1:56

And it can be anybody for any reason, Home Inspectors, they look at everything, from the roof, to the basement, plumbing, wiring, all that kind of stuff. They’re gonna find stuff that you, as an owner, are probably not even aware of. They will write a report, if they’re any good, that’s going to be pages and pages long. And list things that will surprise and shock you.

Conrad 2:19

At the end of that they’re going to give the inspection report to the seller, but it’s owned by the buyer. The buyer’s paying for that out of their pocket. So you have access to it as a seller, you have the knowledge of it. But, you know, if somebody else, if this falls out, this deal falls out, we get another deal with somebody else, you can’t give that inspection report to anybody else, because you don’t own it. The only thing you should do, because they told us about something, and if the deal falls out of escrow, you need to update the disclosure.

Conrad 2:49

I’ve already talked about a septic inspection, or a well inspection, termite inspection, water testing, lead paint test, they could do pretty much whatever they want. And at the end of that 10 days, or seven days, or whatever you negotiated that inspection period to be, they are going to respond to you.

Conrad 3:08

Oh, during the inspection period, you’ve got five days to get them all those disclosures, which is why I wanted you to sign them back in the episode or two ago. Have those all ready to go. So you’ve given them the disclosures.

Conrad 3:21

They’ve done their inspection. They know everything they’re going to know about it. Now at the end of that inspection period, they’re going to respond with a BINSR, the Buyer’s Inspection Notice and Sellers Response, the BINSR.

Conrad 3:35

They’re going to do one of three things. They’re either going to accept it as is, which makes us all happy and we go on down the road. They’re going to reject the house, which means it falls out of escrow and everybody’s sad, and we have to put it back on the market, which is why we want a short inspection period. Or they want stuff. They come back, give you an opportunity to repair. You know, the roof, the plumbing, the leak under the sink in that back bathroom, you know, whatever it is.

Conrad 4:04

Sometimes, it’s nickel and dime stuff. And at that point, you’re like, “how about we give you 500 bucks, you have it fixed later?” And they’re like, Yeah, fine, whatever. That’s cool.

Conrad 4:14

If you want to fix it, I’d hire the cheapest, worst contractor you could do to fix it. Why spend money on it? You know, they should be fixing it themselves.

Conrad 4:24

So what they’re probably going to do is ask for money, or they’re, technically they’ll ask for a list of stuff. We’ll counter that and say, in lieu of repairs, we will offer you $2,000 or, or whatever. They can ask for the world. They can ask for whatever.

Conrad 4:41

And as I always say, negotiate everything. Everything’s negotiable. You can say no, you can say yes, or throw them money, whatever you want. And that’s, you know, you’re gonna have to look at what those issues are, what the nature is. Generally most inspections, you throw money at stuff and it goes away.

Conrad 5:00

Very rarely do they accept it as is. There’s always something wrong. They’re always gonna ask you for something. So they ask for stuff, you respond, either here’s money or no, we’re not giving you money. And at that point, they can reject it and walk away, and we’re all sad again. Once that’s resolved, the inspection period is over, they have no rights at that point to inspect anything.

Conrad 5:21

The next point then is, we go to the loan, if they have a loan. If you got a cash deal, just fast forward through this whole next part.

Conrad 5:30

If they got a loan on it, they’ve got to get an appraisal to prove to the lender how much the house is actually worth. And that contingency is in the contract, unless you negotiated it out, upfront, which probably didn’t happen.

Conrad 5:45

You’ve got this appraisal contingency. If it doesn’t appraise… Let’s run through some numbers, I’ll try to make this simple and make the math easy. Let’s say you’ve got a $500,000 house, and the lender wants a “loan to value”, they’re willing to loan 80% of the value of the house, they want a 20% down.

Conrad 6:08

So 80%, the loan would be 400,000 on a $500,000 value, right? That makes sense. 20% down 80% loan $500,000 value. Now, their number is 80%, not necessarily the hard dollar figure, they want a percentage.

Conrad 6:26

Now let’s say it appraises for $400,000. Well now they want 80% or they’ll loan 80% 80% of $400,000 is only $320,000, they’ll only loan $320,000 on a $400,000 value, you know, because of the 80% before they want a 20% down on a $500,000 house.

Conrad 6:53

So that was $100,000 down? Well, now it only appraises for $400,000. They’re only going to loan $320,000. The difference between that $500,000 value and the $320,000 loan is $180,000 down. It’s not the $100,000 down but $180,000.

Conrad 7:14

So does your buyer have that extra 80 grand to throw in? Are they going to pay that cash difference? Are they going to cancel because they don’t have the money or they can’t afford the loan or you know, whatever?

Conrad 7:28

So they’ve got five days to decide what they’re going to do on that appraisal contingency. And you could lose the deal over this. So hopefully that works out well. Another reason to have somebody buying your house, it’s got a large down payment, you know, 30, 35% down payment, or cash, cash is king.

Conrad 7:47

So we’ve gone through the appraisal, we worked out whatever deal with the lender, you know, if we’re still in, if we still got a loan, and the loan is going to be approved, then it goes to underwriting, the lender underwriting, and they check everything one more time.

Conrad 8:02

This is usually a slam dunk, and I’ve never had anything go sideways for me. But it is possible for weird things to happen in underwriting. If the buyer goes out and buys a new car. They just screwed up their credit rating, how much they owe, and all that stuff. And the lenders not going to underwrite it.

Conrad 8:21

You could have an accident, the house burns down or a car drives into it. Well, all of a sudden, it’s not in the same state, as you know, it’s not worth your 500,000 anymore. You could have a natural disaster. You could have a social disaster. What if they have a riot and, you know, whatever.

Conrad 8:36

So let’s say that you get through the financing, the underwriting, the financing, it all works out. The final paperwork with escrow and title is written up. That has to do with the deed. It would have to do with loan docs. If the buyer’s out of the state or out of the area. Maybe we are in Prescott, they’re in Phoenix.

Conrad 8:57

I had one where the sellers were on vacation in Florida, the buyers were in Washington State, and everything had to be overnighted. And, you know, so there’s some logistics here. Everybody’s got to sign those closing docs. They’ve got to be notarized, because there’s large numbers of dollars involved.

Conrad 9:17

You know, things have to be in order with IDs and all that kind of stuff. Mobile notaries are the the heroes of the day in those kind of cases. So everybody signs their closing docs.

Conrad 9:29

Escrow comes up with a preliminary closing statement. And what that does is, it’s got four columns, two for the buyer, two for the seller, asset and debit?, debit and credit?, debit and credit. I hate finances.

Conrad 9:44

And this closing statement should have everything that’s owed to everybody. What everybody’s paying, what everybody’s getting back.

Conrad 9:52

Maybe the sellers got a loan to pay off. So you know, you’ve got to have the payoff statement from their lender. How much is the payoff going to be. Escrow pays them off before they can write the new deed to the new owner. You know, the liens need to be paid off.

Conrad 10:08

Transfer fees for like septic tanks, well transfers, I think they’re like 30 bucks apiece or something. You know, there’s a lot of, points on your loan, all the lender stuff. This is like a huge long document. As the seller, you need to go through there, make sure everything is correct.

Conrad 10:26

They’re usually 95%. Correct. There’s always one or two little “Oh, hey, did you know about? Oh, sorry, I missed that.” And, you know, we go fix it. That has to be all worked out.

Conrad 10:39

I’ve heard of problems in signing, you know, there could be an error. There could be a misunderstanding. People didn’t, you know, didn’t think that person was going to pay for that.

Conrad 10:49

I’ve heard of people going into the escrow office and refusing to sign because they were surprised by something on that statement. You know, somebody could get mad, “I’m not paying for that transfer fee. I’m not paying for you know, whatever” cases like that. It’s like if I’m there, it’s like 30 bucks, I’ll pay for your well transfer fee. You know, don’t worry about it.

Conrad 11:12

Property taxes are included in that. Property taxes are weird. They’re paid in arrears in Yavapai County. So every October you pay for the previous year. And escrow pro rates that all out. I didn’t want to think about it. It makes my brain hurt. But they figure how many days into the year, how many days of tax, at whatever rate, they they prorate that and it all comes out fair. I just accept whatever they give me on that stuff.

Conrad 11:42

So okay, so we’re through the title. We’re through the statement. If everybody’s good with that, if all the closing docs have been signed, then we’re ready to record. Escrow has to wait for the funds from the lender.

Conrad 12:00

They wire the funds, sometimes that takes longer than we’d like. Sometimes getting signed documents takes longer than we like.

Conrad 12:09

I had one deal where escrow was up here in Prescott, the seller was in Phoenix. So they signed the all the closing docs down in Phoenix, because it was just easier. And then they overnighted it. I don’t know FedEx, UPS. I think it was FedEx, I don’t know, shouldn’t slam anybody without knowing they overnighted it, paid like 65 bucks to have it overnighted.

Conrad 12:33

And it didn’t show up and it didn’t show up. And they called, they chased it. Three weeks later, it finally showed up. In the meantime, Oh My Gosh, we’ve got to close. They ended up having to drive up here, go into the office and sign in person.

Conrad 12:49

So usually the overnight thing works. You know, that was just a weird fluke, there are things that can go wrong. I do not relax until we’re done on this. So we’ve got everything done. Money has, you know, been funded by the lender. And escrow sends it off to the county to record. And nothing is legal until it’s recorded with the county.

Conrad 13:13

I think the closing before last, we closed at 4:59pm. You know, and they close at Five o’clock, the office closes at 5:00pm. 4:59pm!. It’s like at that moment when you record that document, that is when the buyer owns the house and the seller no longer does.

Conrad 13:33

So if a meteor crashes through the roof a minute before, it’s the the sellers responsibility on their home insurance. If it’s a minute after, then it’s the buyers responsibility. It is that moment that they record.

Conrad 13:49

So hold your breath until you actually get that phone call that you’ve recorded. The most important part of that process is that my commission check gets messengered to my office, because I got to get my money out of this!

Conrad 14:03

So let’s say we’ve closed, and you know that things recorded. There are no more legal rights, no more legal obligations, that property belongs to somebody else. It belongs to the buyer. Everything changes. And the deal is done. It’s closed.

Conrad 14:20

And at this point in time, this was this is kind of a weird time can be weird. Generally, the buyers very, very excited. My favorite part of my job is calling a buyer to say we have closed is your house, congratulations.

Conrad 14:36

And they scream, they laugh, they dance around. They’re very happy. And that’s, that’s just a very cool thing. I’m very proud to be a part of that. That makes my job worthwhile.

Conrad 14:49

The seller, the seller, probably happy because they want to sell it. But I’ll tell you, man, selling a house, is very emotional, and you might end up sad. You might be sadder than you expected because, you know, maybe you love that house, maybe that signifies a part of your life is over now, you know. You raised kids in it. Your kids are grown and you now you’re in a new phase of life.

Conrad 15:18

I remember when we sold our house, that we’d lived in for 24 years. I think it took me two, or two and a half years to get over being sad about that. I was, as much as I love living here in Prescott, we moved here from out of state, and I love where I live in Prescott, no regrets whatsoever, but I loved my house before too.

Conrad 15:40

I mean, a lot of memories, a lot of emotional involvement. And, you know, I was kind of pissed off at the guy that bought it, for a long time. And, you know, I got over that.

Conrad 15:51

My wife recently had a dream she told me about, where in the dream, the guy who bought our house offered to sell it back to us at the price we had originally bought it for, like 30 years ago, an insane price. And she thought, No, I don’t want to do that. Much as I love that house. I want to live here in our house in Prescott.

Conrad 16:15

You know, so there is a future. It’s good to look forward. Life gets better, and it can be emotional to go through that change. Hopefully you’re happy because you just got a bucket of money. You know, that kind of helps the the sadness a little bit.

Conrad 16:32

A lot of the time, it’s a relief going through this process. It can be stressful and you’re not quite sure how it’s going to end up, and, and all that, and to get through it is a relief.

Conrad 16:41

But be prepared for some sad, but look forward to the happy. No matter what happens, either way, that part of your life is over. And a new part is beginning. You need you need to look forward to what comes next.

Conrad 16:55

You need to be thankful that you got through the process. Be happy about everything that life brings you. Embrace the future and, and just be grateful about everything, and you sold your house. Be thankful.

Conrad 17:08

Thanks for listening. Please drop a review wherever you get your podcasts. If you have any questions or need any help with real estate in Prescott, please give me a call or text me at 928-925-4428. You can email me at Conrad at PrescottRealEstate.com. You can always contact me through the website, where you can also get show notes with information about this episode. That’s PrescottRealEstate.com.

Conrad 17:36

The key life is gratitude, so stay thankful.

Leave A Comment